Travel insurance is usually offered by the cruise line when you book your cruise, or as an add-on shortly after your purchase. But should you purchase the cruise line insurance or buy it yourself? We’ll explore the differences in this article.

Purchasing travel insurance will protect you in the event you need to cancel your cruise due to illness or other covered reasons, and also typically offers coverage for medical issues during your vacation as well as other issues that might arise, such as a missed flight or lost luggage.

Cruise line insurance policies are typically priced affordably to make them an easy “sell” — Carnival’s Vacation Protection plan starts at $49 per person, for example.

But is a cruise line travel insurance policy the best way to protect your vacation investment?

Here are some things to consider before hitting “buy.”

Things to Know Before Buying Insurance From The Cruise Line

1. You’re buying a group policy

This isn’t necessarily a bad thing, but what it does mean is that, unlike other options, there is no customization available.

It doesn’t matter if you’re 8 or 80, you will pay the same amount for the coverage and receive the same benefits as other travelers. The policy is based on the cost of the trip and not the traveler’s age, health or other factors.

2. The Cancel for Any Reason (CFAR) benefit is limited

With the amount of uncertainty in the world — not to mention how much money you’re laying out for a cruise — CFAR coverage is a smart investment.

Carnival’s Vacation Protection offers limited CFAR coverage, but there’s a major difference between this coverage and what you’d find in a similar policy purchased from another source: While both may cover a large percentage of the cruise fare, Carnival’s policy does so in the form of a future cruise credit as opposed to an actual cash refund.

The future cruise credit is issued based upon the non-refundable costs of the voyage, not the entire fare as taxes/port fees and prepaid gratuities are considered to be refundable money.

READ MORE: Understanding Cancel For Any Reason Benefits

3. Your policy could prove worthless if the cruise line goes out of business

Until recently, it was almost unthinkable that a major cruise line such as Carnival, Norwegian Cruise Line or Royal Caribbean might simply close up shop. But it was equally unthinkable that all of the major brands would simply stop sailing for an extended period of time.

But we’re not living in normal times, and financial concerns in the entire travel industry are very real. Most travel insurance sold by the cruise lines doesn’t protect you if the supplier — aka the cruise line itself — goes out of business.

For this reason alone, an independent insurance policy, like those sold by travel insurance comparison site TripInsurance.com, might be a better investment, as those policies typically include bankruptcy protection, allowing you to recoup your money if the company goes out of business.

Real World Travel Insurance Example

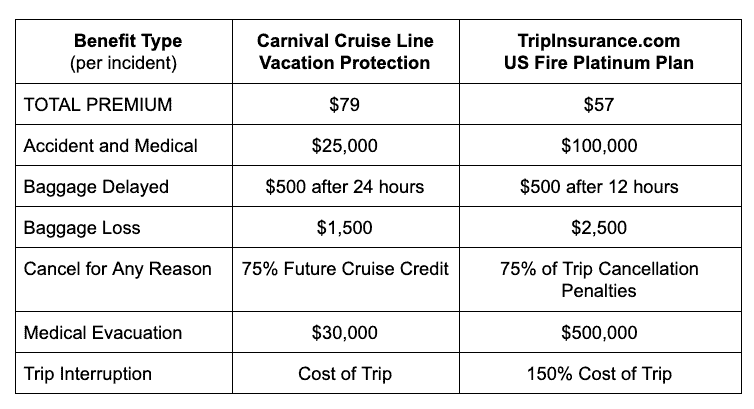

For comparison’s sake, let’s look at the cost of two different policies covering a 40-year-old passenger’s seven-night Caribbean cruise costing $589 per person.

For the example below, we compared Carnival’s Vacation Protection policy with what our passenger would be offered via a price comparison search at TripInsurance.com.

While the Carnival Vacation Protection premium is the better “bargain” at $79, it also proves to be a case of “you get what you pay for.”

The coverage and benefit amounts – almost across the board – are substantially lower than what’s offered by shopping travel insurance yourself.

The cruise line’s policies will vary in regard to coverage for pre-existing health conditions. Many of them (like Carnival) have a 60 day look back period to determine if pre-existing health issues will be covered.

So if you have had any new diagnosis of a health issue, changes in diagnosis for an existing condition or any changes in medications or treatments for a condition, then a claim made on the policy can result in a denial if the reason is related to that health condition.

Which is the Best Travel Insurance Option?

![First Time Cruise to Europe + Cruise News [Podcast]](jpg/1681310099-msc-world-europa-maiden-call-genoa-italy-1-300x206.jpg)