Building cruise ships is a complex web of challenges and decisions – not to mention financial considerations – with one significant thread: the profound impact of legislation and regulations.

Beyond the realm of regulation, economic constraints, including higher labor costs and limited access to funding, can cast a vast shadow over the viability of American shipyards as preferred choices for cruise ship construction.

Why aren’t cruise ships built in the United States?

US shipyards face myriad challenges when building cruise ships, not the least of which is the impact of legislation and regulations.

For instance, the Jones Act requires that any ship transporting goods between two US ports be built in the US, owned by American citizens, and operated by a crew primarily composed of American citizens.

This law, enacted decades ago to protect the American shipbuilding industry, has inadvertently hindered the competitiveness of American shipyards.

Compliance with existing regulations can significantly increase the construction cost of a cruise ship and, in turn, dissuade the cruise industry from choosing US shipyards for their projects.

Combine this with financial incentives for American shipyards to pursue military and defense contracts. Suffice it to say it has been many years since a cruise ship was built in the US.

Economic Constraints

The economics of cruise line construction also plays a significant role in the reluctance of cruise companies to opt for US shipyards.

- Higher labor costs: American shipyards tend to have higher labor costs than their international counterparts, particularly those in Europe and Asia, where many cruise ships are built. These cost disparities can make constructing a cruise ship in a US shipyard less financially attractive for today’s cruise operators.

- Limited availability of funding: Securing loans and financing for US shipyards to build cruise ships can be challenging, as banks and financial institutions may perceive the projects to be high-risk investments due to the complexities and uncertainties associated with cruise ship construction.

- Diminished expertise: Considering the intense focus on military and commercial contracts, there is a relative lack of recent experience in constructing modern-day mega-ships, which raises concerns regarding US shipyards’ to deliver a profitable and timely product.

In conclusion, the challenges faced by US shipyards in building cruise lines stem from a combination of legislative, regulatory, and economic factors. These obstacles discourage cruise operators from choosing American shipyards for their construction needs.

Despite the hurdles, fostering innovation, strategic investment, and adopting new technologies may help US shipyards narrow the gap and become more competitive in the global cruise construction market.

Comparison Between US and Foreign Shipyards

Quality of Equipment and Infrastructure

In terms of quality of equipment and infrastructure, there is a notable difference between US shipyards and their foreign counterparts.

European and Asian shipbuilders are known for their advanced technology and high-quality equipment designed for shipbuilding.

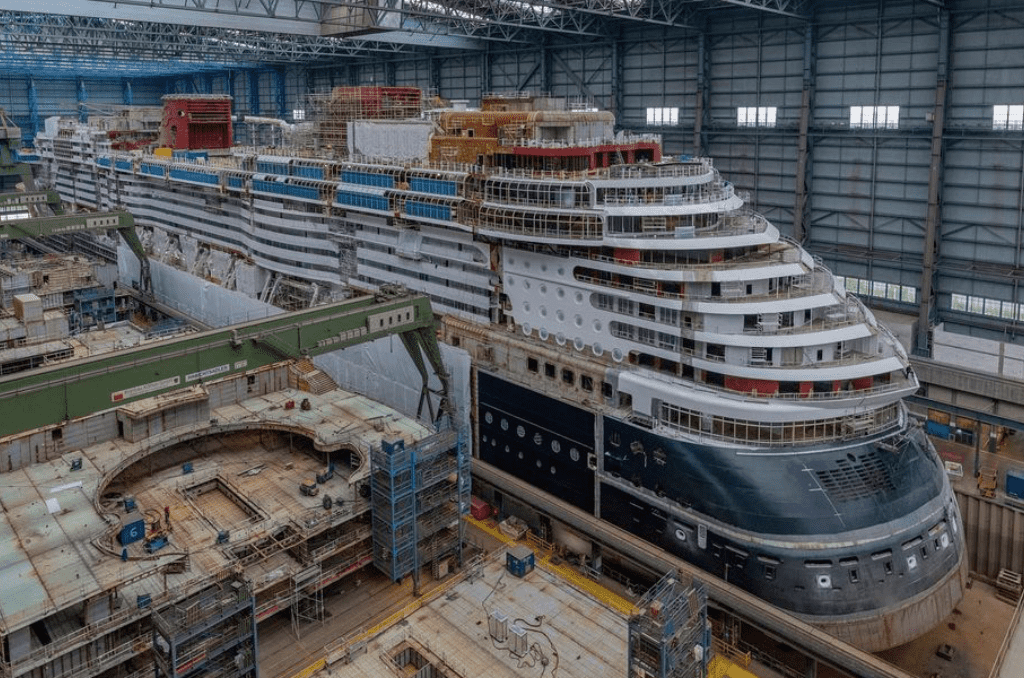

European shipyards, including Fincantieri in Italy, Meyer in Germany and Finland, and Chantiers de l’Atlantique in France, have a longstanding reputation for producing high-quality vessels through a well-established infrastructure as well as a tradition of fine craftsmanship, with many ports equipped for various types of ship construction.

In South Korea, shipbuilders like Hyundai Heavy Industries and Samsung Heavy Industries possess technology ahead of the curve, making them frontrunners in the industry.

Meanwhile, China has been actively investing in the latest shipbuilding technologies and equipment, positioning itself as a significant player in the global market.

Japan is also known for its top-of-the-line shipbuilding facilities and equipment, especially regarding automated processes and high-precision machinery.

US shipyards have historically focused more on constructing naval and military vessels, with less attention paid to commercial shipbuilding. Modern equipment and infrastructure tailored specifically to completing cruise ships are less standard in America than foreign shipyards.

Labor Costs and Supply Chain Factors

Labor costs can significantly impact the choice of shipyard location for cruise lines. Countries like China and South Korea often provide relatively lower labor costs than US shipyards, making them an attractive option for shipbuilders.

Below is a breakdown of the typical hourly wage for ship construction employees worldwide based on data provided by European, US, and Chinese shipyards.

| Location | Hourly wage |

|---|---|

| Europe | 14.23 hour |

| United States | $23.70 hour |

| China | $5.93 hour |

In addition to labor costs, supply chain factors are another crucial consideration for shipbuilders. Many foreign shipyards benefit from proximity to the suppliers necessary for cruise ship construction.

In Europe, for example, a well-established network of suppliers is tightly integrated with the shipbuilding industry, providing raw materials and specialized components. Such proximity reduces material costs and logistical challenges while accelerating the construction process.

Although currently advantageous to cruise ship companies, shortages due to geopolitical events and other issues can lead to challenges, as we saw in 2022 and 2023, with shipyards’ Russian steel deliveries being affected by sanctions imposed during the Russia-Ukraine conflict.

Frequently Asked Questions

How long does it take to build a cruise ship?

In recent years, the design and manufacturing of cruise ships have undergone significant changes to meet the evolving demands and expectations of passengers and various regulatory bodies.

The time required to build a cruise ship can vary significantly depending on the ship’s size, complexity, and the shipyard’s efficiency. On average, constructing a mid-sized cruise ship can take approximately 18 to 24 months from the initial design phase to the ship’s delivery.

Remember that a more significant learning curve with a prototype ship – the first in its class – can often affect the delivery timeline.

A series’s second, third, fourth, and beyond are usually based on a similar platform, so delays are less frequent. A more significant learning curve with a prototype ship – the first in its class –

What prevents American shipyards from building cruise ships?

Several factors deter American shipyards from building cruise ships. Firstly, the constraints imposed by the decades-old Jones Act require vessels transporting passengers and goods between US ports to be built in America.

This limits potential builders and increases the cost of construction. Additionally, US shipyards lack the specific technical expertise and facilities required to construct today’s modern floating resorts.

The reliance on defense and military contracts makes building a cruise ship in the US virtually unheard of.

Why do major cruise lines prefer non-US shipyards?

Major cruise lines prefer non-U.S. shipyards due to their pool of experienced labor, lower costs compared to the US, and a longstanding tradition of building advanced, large-scale cruise ships.

Additionally, non-U.S. shipyards offer cost-effective solutions and are equipped with extensive facilities that can accommodate multiple vessels simultaneously, which is attractive to cruise lines.

How do international shipyards compare to those in the US for cruise ship production?

Generally speaking, European shipyards are better equipped for cruise ship production as they possess the expertise, capacity, and facilities to construct large-scale cruise ships.

Moreover, international shipyards are often more cost-effective due to lower labor costs and availability of goods and services needed to equip these massive mega-ships.

![First Time Cruise to Europe + Cruise News [Podcast]](https://cruiseradio.net/wp-content/uploads/2023/04/1681310099-msc-world-europa-maiden-call-genoa-italy-1-300x206.jpg)